OPTISAVER products are designed to help you earn more and save better.

We have two savings products, OptiLock and OptiFlex

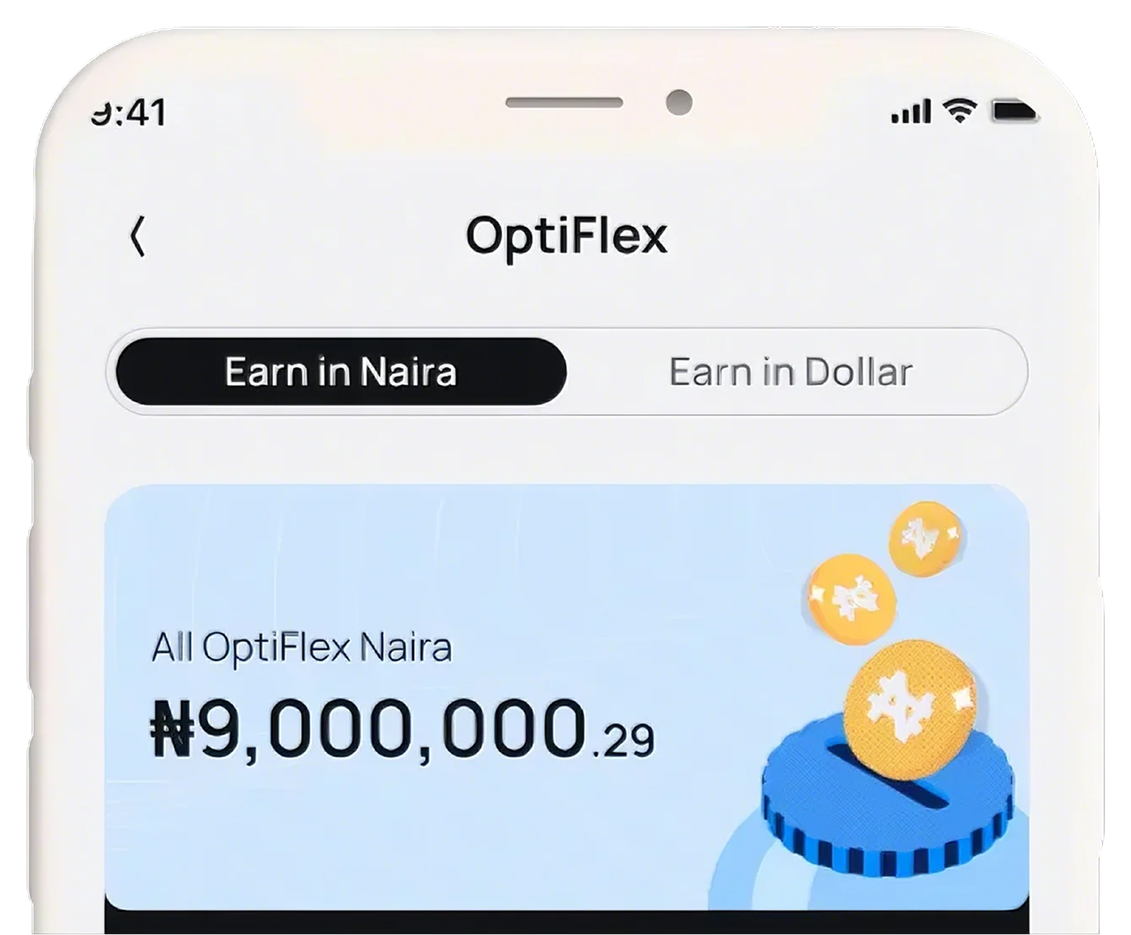

OptiFlex is a target savings plan that assists a client to save in a disciplined manner by automating the client’s debit instructions. This plan offers clients a fixed interest rate per annum and allows them to withdraw their funds at any time

2. OptiLock is your vault. We all need to strategically save as we earn. OptiLock allows you to save any amount of money and select a savings tenure be it 30 days, 60 days, 90days, etc. depending on a customer’s saving culture